I am so excited for what I am about to tell all of you! I realize, though, that this might only be intriguing to the other like-minded accountants (or partly OCD people) of this world, but seriously, I cannot contain this nerdy excitement.

For a long time I have been wanting to set up a personal finance program (probably using excel) and this week I spent several hours getting started on this. Yesterday, I mentioned to my coworker that my goal for the weekend was to get this program completed. She then proceeded to tell me about this website that she uses to track her finances. After just a couple minutes of discussing this site, I realized there was no way I could create something as perfect as this (and it's free!). So, while I couldn't sleep last night (thanks to the two hour nap I took after work), I set up my account on this (freaking cool) site--mint.com.

Let me explain how it works...

You connect all of your bank accounts, loan accounts, investment accounts, etc. to this site (it's through Intuit and it's completely secure). This process literally took about twenty minutes (and I connected eight accounts).

When there is activity in one of these connected accounts (as you use your debit/credit card, write checks, make loan payments, make transfers, etc.), the information is transferred to this site.

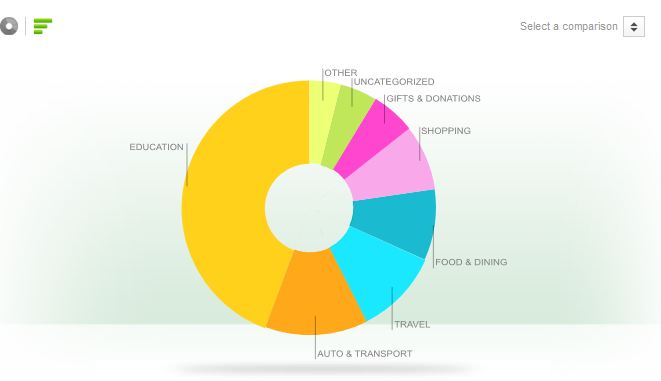

Then, all of the transactions are automatically categorized. So, if I put $10 on my credit/debit card at Cinemark, this would automatically be categorized as 'Movies & DVDs."

But, if you don't like how something is categorized, you have the ability to change (or split it between multiple) categories. For example, if I made a purchase at Wal-Mart, it would automatically be categorized as "Shopping." If I want to, I can go in and change this categorization to "Hair and Makeup" or "Groceries" or "Clothing" or split it between whichever categories I want to. You can also add categories--I added a category called "Christmas Gifts 2012."

Another cool feature is that you can tell it how to categorize future payments. For example, I have it set up so that any check I write for $10 will be categorized as "Doctor" as any $10 check is likely to be for an office copay (but I can go back and change it if it's not).

You can also add a note and/or tags to each transaction. As you can see above, I have a "reimbursable" tag and any work-related travel expenses will be tagged in this manner.

But wait, there's more!

You can set up monthly budgets to help you manage your spending. You decide the categories and your budget. You can set it up so that if you go over budget in any one category, a text or email will be sent to you (you can also have texts/emails sent if any one of your bank accounts go under a certain amount, if any one purchase is greater than a certain amount, etc.)

You can create goals (like buy a house, save for a trip, pay off a loan, etc.) and your progress will be tracked automatically. I set up a student loan goal to help me with Number 2. While setting this up, it calculated that I will save $6,674 in interest if I meet my goal. Holy moly!

You can also view your spending trends, analyze your portfolio performance, and do soooo many more helpful things.

The best thing about this website is how ridiculously user friendly it is. I literally set this up last night and feel I can navigate my way through this site/my account with ease. The second best thing (it might actually be tied for first), is that it is completely, one-hundred percent free. How? Well, advertising of course. But not the obnoxious kind of advertising....advertisements are on the "Ways to Save" tab where you can go to browse different ads (for loan providors, brokerages, etc.). That's it. Seriously, it's not obnoxious at all--these ads might even be useful someday.

Anyway, I am beyond grateful that my coworker (who is, by the way, the most organized person I have ever met in my life--but that's another post altogether) enlightened me with this whole thing and all I want to do is share this with everyone I know.

FYI, after rereading this post, I feel like a spokesperson for Mint.com. I swear I'm not, but I might actually look into that! :)

Enjoy!

No comments:

Post a Comment